Caring for a child can be very difficult, and this can carry twice the burden if a parent is a sole carer having split from the other parent. However, both parents are required by law to financially support their children until the age of at least 16. This means that the parent who the child predominantly lives with is entitled to some form of financial support from the other parent, and this normally comes in the form of a Child Maintenance Arrangement.

Related: Learn how child custody lawyers may be able to support your family or sort out finances in the event of a divorce or separation.

Topics to be answered in this article

What is a Child Maintenance Arrangement?

A Child Maintenance Arrangement, perhaps more commonly known as Child Support, is an arrangement between two parents who do not live together. It decides how much the parent who is taking care of the child/children should receive from the other parent. This payment is there to support the ability of the parent looking after the child/children to raise them.

How do I know if I’m entitled/eligible?

If you are solely caring for your child, then more often than not you will be entitled to some sort of Child Maintenance, as it is an obligation by law. To qualify, your child must be under the age of 16 or be below the age of 20 whilst still in full-time education/college etc. They will also have to be predominantly living with you. You don’t have to be their parent to be entitled to child support, as long as you are their primary caregiver.

From the point of view of the person who must pay child maintenance, you would have to do so if you are the biological parent of the child/are the child’s legal parent and you don’t live with them.

How to make a family-based arrangement?

Fortunately, many Child Maintenance Arrangements are made within the family, but this should still be done with some sort of formal agreement. The best way to do it is to work out how much each parent is earning, calculate how much it costs to raise the child/children per an allocated amount of time (typically monthly payments) and then decide between you how much each of you should be contributing towards this value. This decision should take into consideration the living arrangements, visits as well as the financial position of both parents.

Discussions for this don’t have to be formal, but to avoid any difficulties/disputes down the line, forms should be used with details of the arrangements. A solicitor would be the best way of producing a valid form.

If this isn’t possible, there is an alternative way to go about receiving child maintenance, which involves GOV.UK. This is called the Child Maintenance Service.

How to use the Child Maintenance Service

The Child Maintenance Service (CMS) is an alternative way of sorting out child support through the government if it hasn’t been possible to establish an agreement between parents in person. It is an online form provided by GOV.UK to make arrangements on your behalf with the other parent. It is the cheapest way to go about the process and includes both the ability to manage the process throughout as well as passing the case onto someone else to complete on your behalf. This has now officially replaced what was previously known as the Child Support Agency. Complete your own case using the CMS.

How much child maintenance should I pay?

The amount that you should be contributing/receiving completely varies depending on the situation. Monthly payments are most common, but this isn’t always the case. As previously mentioned, lots of factors need to be considered, including the amount of time the child stays with each parent, the financial situation of both parents and any extra costs that may be involved, extra-curricular or otherwise.

Before going through the CMS process, you can simply use the GOV.UK Child Maintenance Calculator to see roughly what you are entitled to or what you should be paying.

The CMS base their assessment on the non resident parent’s gross income being all income from employment, self employment and pension income. Dividends in excess of £2,500 gross per annum will also be considered. Pension contributions can be deducted from gross income so long as the contributions are not being diverted with the intention to reduce what should be paid. Sometimes other expenses can be taken into account such as costs of the non resident parent in travelling to see the child.

£7 per week is the payment required for those non resident parents with a gross income of less than £100 per week and a reduced rate is payable for gross incomes of between £100 and £200 per week.

Payable amounts based on income

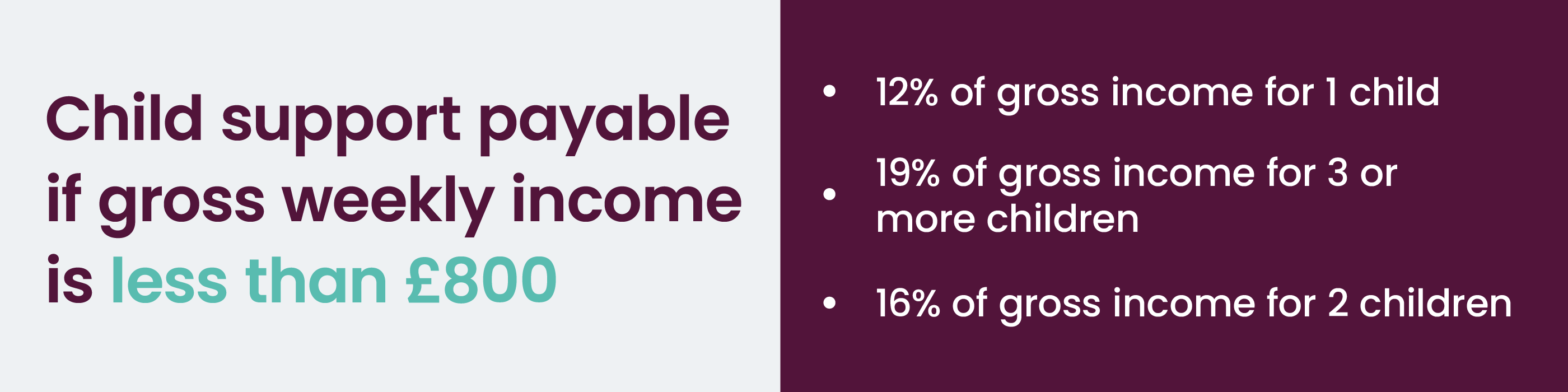

If the non resident parent’s gross weekly income is not higher than £800 the child support payable will be 12% of your gross income for one child, 16% for two children and 19% for 3 or more children.

If the non resident parent’s income is between £800 and £3,000 the child support payable will increase for income in excess of £800. This will increase by 9% for 1 child, 12% for 2 children and 15% for 3 or more children.

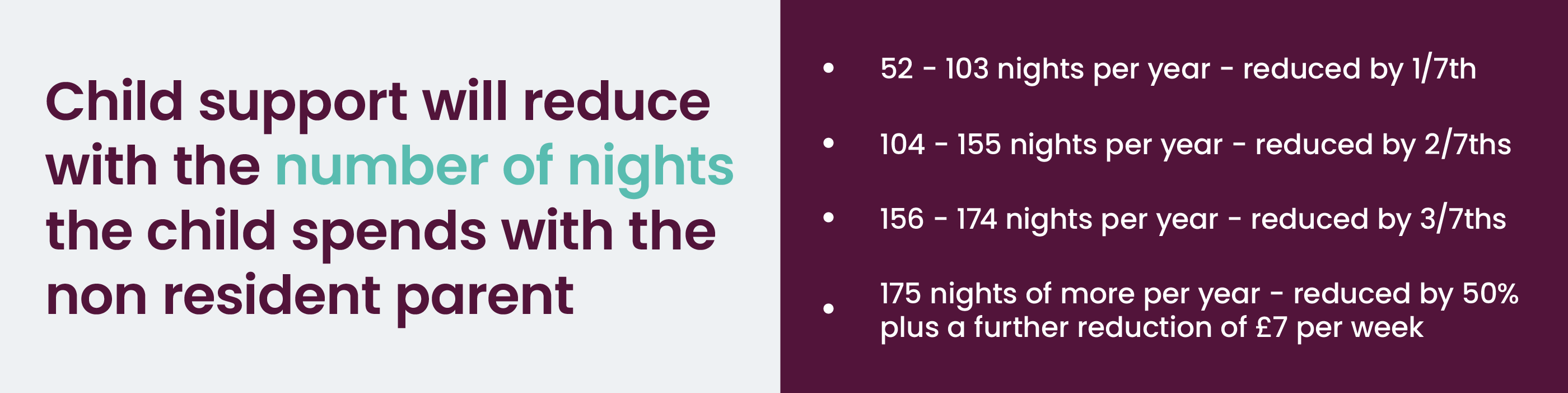

The amount payable, as set out above, will reduce in accordance with the number of nights (overnight contact) the child spends with the non resident parent. Child support will reduce by 1/7th if the child stays between 52 -103 nights per year, 2/7ths between 104 – 155 nights per year and 3/7ths between 156 -174 nights per year. This can then be reduced by 50% plus a further deduction of £7 per week per child for overnight contact of 175 nights of overnight contact or more per year.

There is no maintenance liability if there is a shared care arrangement i.e. where the child spends an equal amount of time with each parent.

Reductions will also be made if the non resident parent has other children living with him/her and child benefit is paid to the household. The reduction would be a further 11% for one child, 14% for two children and 16% for three or more children.

Going through the courts

If the CMS doesn’t work out the way you had hoped, the final option is to go to court, which will cost you more and is potentially more risky, but if you have the right solicitors it can work out for the best.

If you were to go through the courts, Goughs have highly trained solicitors and advisors for the job to make the process as smooth as possible. It will always be a difficult arrangement to make for various reasons, so allow us to make it simpler for you.